Creating strategic opportunities

Out of the financial hardship of COVID, a unified payment assistance service was born. As the product and design lead, I navigated a shifting enterprise environment to secure funding for the program.

Objective: Secure funding for the development of a unified payment assistance service

Role: Design lead, Product lead (after her departure)

Company: Wells Fargo

Team: LOB partners, Business analyst, Digital strategy, User research, Product designers, Engineering, Content strategy

Responsibilities

Partnered with product to create vision

Evolved direction after departure of the the product lead

Augmented & maintained partner relationships

Guided the creation of the customer journey with strategic & design team

Directed the creation of the concept through iterative testing

Worked with leadership to secure funding

How did we do it?

Exploratory Research · Product Narrative · Business Case · Jobs-to-be-done · Concepting & Iterative Research · Executive Pitch

1. Conducted exploratory research

Collaborating with a researcher, we explored how distress affected decision-making around people’s finances. We gathered feedback from the existing COVID program and synthesized existing research to identify these key insights:

customers were strategic about their finances when in distress,

empathetic treatment increased reciprocity towards the bank, and

avoiding a debt spiral early increases the chance of success.

2. Established product narrative

Data showed that helping customers make payments early during hardship reduced their likelihood of entering the debt cycle. Finding the synergy between business and customer objectives, I guided the team to write the customer problem statement, develop principles and establish the direction.

3. Expanded business case

Unfortunately, my product partner left the company and I took the reins. We needed to expand the business case to get approval for a team. To do this, I drove the following:

deepened partner relationships to keep a pulse on strategic initiatives and known gaps,

completed landscape and SWOT analysis,

identified natural disasters as a high-impact use case after exploring the associated P&L,

facilitated customer journey mapping workshops with product and design to identify KPIs based on business needs, customer needs and known pain points, and

engaged product strategy partner to build the detailed business case.

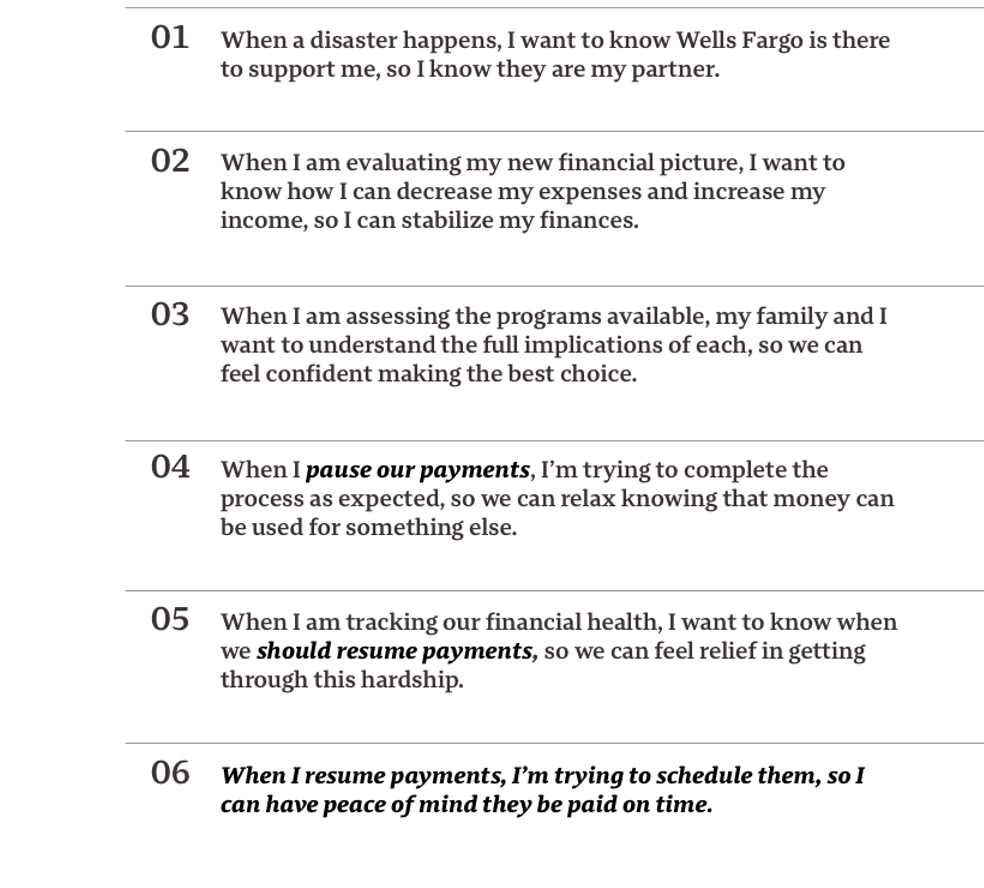

4. Crafted Jobs-to-be-done

As an individual contributor, I crafted the Jobs-to-be-done. Using company priorities, technical limitations and LOB feedback I worked with the team to prioritize the Jobs-to-be-done.

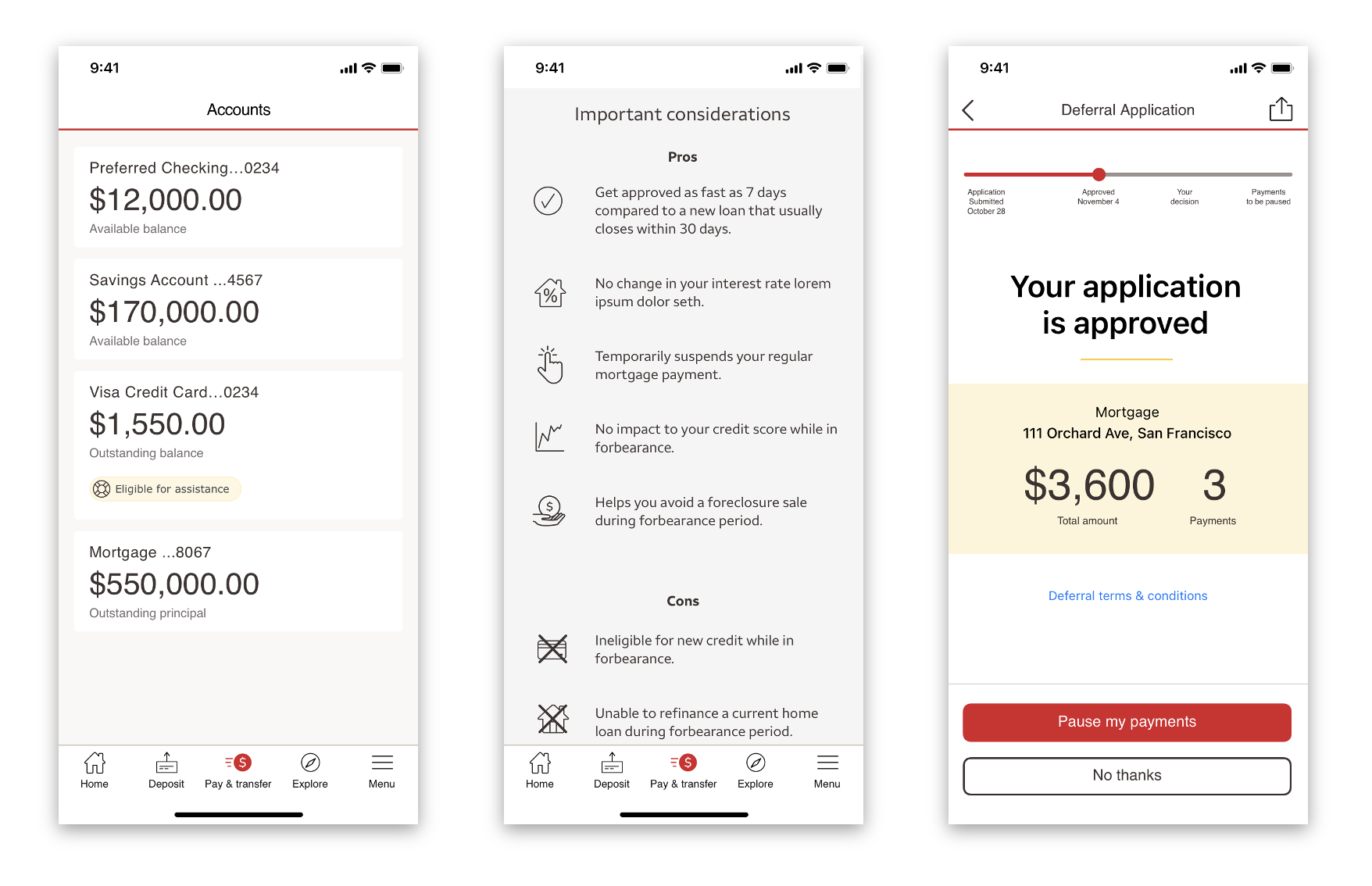

5. Iteratively tested concepts with newly established team

After securing a team of two designers, one content strategist, and a business analyst we ran a design sprint to develop our initial concept. Using a narrative-based approach based on the Jobs-to-be-done, the team sketched possible solutions. Collaborating with the researcher, we designed a program to iteratively test the designs and nomenclature. Our objective was to create a user-centric experience that generated positive customer sentiment. The research generated these insights:

engagement at the account level drove early access to the program,

transparent pros and cons built trust,

an ‘approval’ gate aligned with the customer’s mental model and provided a necessary ‘cooling-off’ period, and

the label ‘Financial Relief’ evoked a positive emotional response.

Concepts for testing

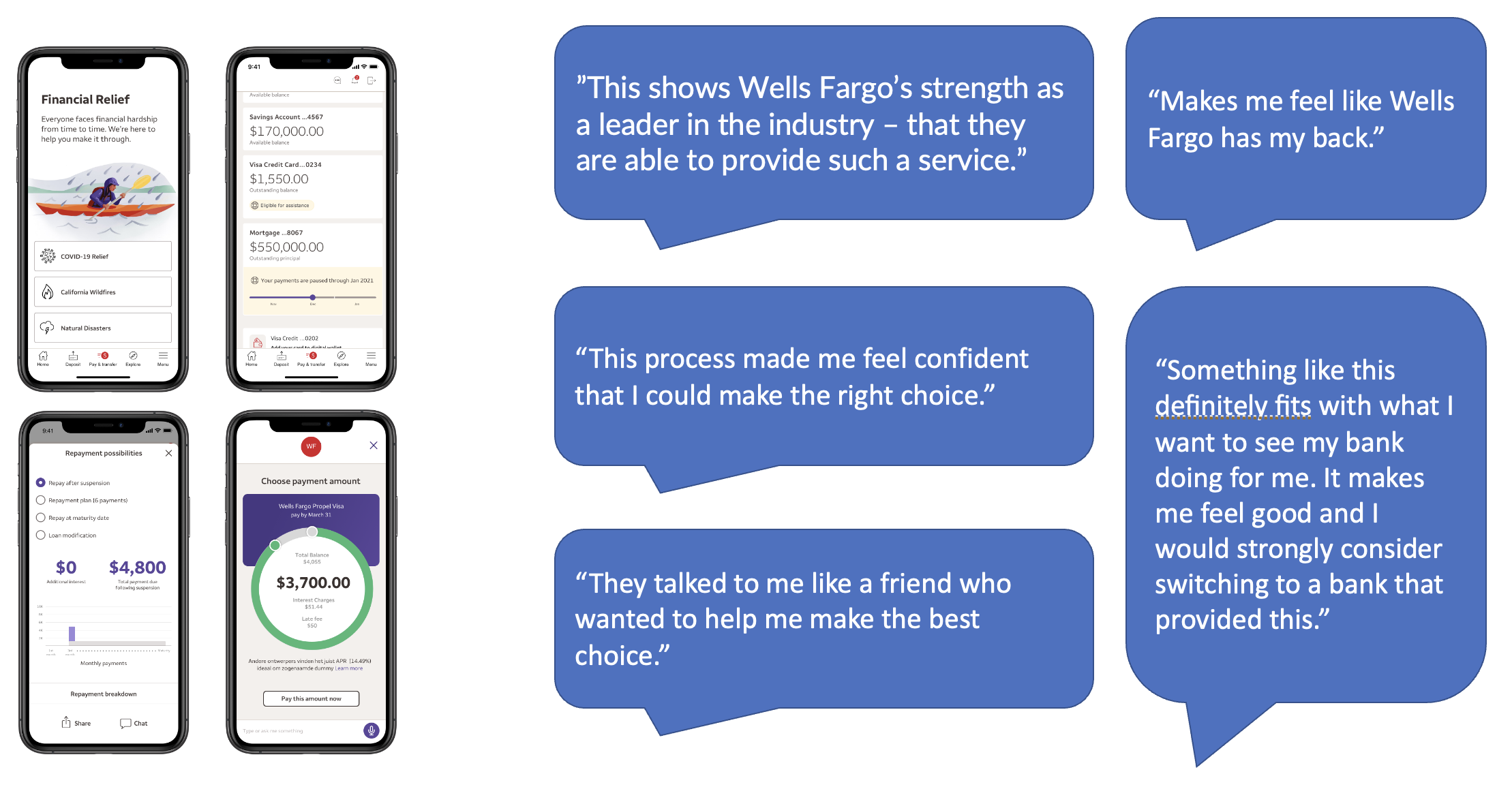

6. Created executive pitch with research-backed concepts

Based on the findings, the team developed a pitch featuring a Financial Relief Center, Conversational UI, and Tracking tools. We incorporated customer feedback from research, validating that our approach could rebuild trust in the brand. Through collaboration with leadership, we secured executive funding for the program.

Final concepts & user quotes from research